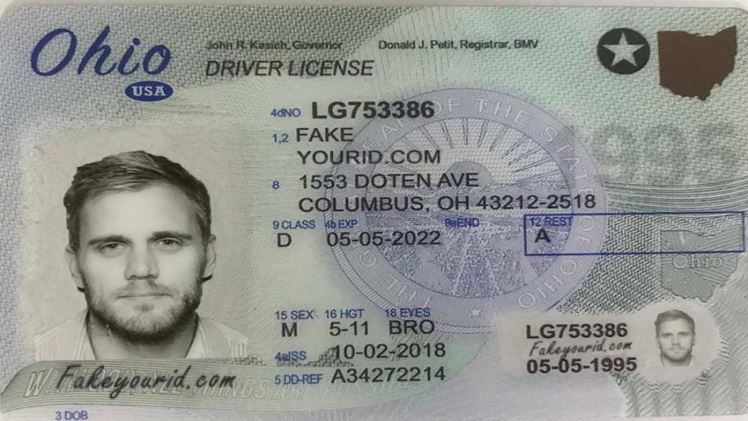

The issue of fake IDs extends far beyond the realm of underage individuals seeking access to age-restricted venues. A more sinister aspect involves the use of counterfeit documents, including fake driver’s licenses, in committing financial fraud. This form of deception not only undermines the integrity of financial institutions but also poses significant risks to individuals and the economy at large. This article explores the critical intersection between fake IDs and financial fraud, detailing the mechanisms of such frauds, their impact, and the strategies for mitigation.

Mechanisms of Financial Fraud Using Fake IDs

Opening Fraudulent Accounts

One common method of financial fraud involves using fake IDs to open bank accounts or secure credit cards. Fraudsters utilize counterfeit documents to create identities that pass initial verification checks, enabling them to accumulate debt or launder money without the risk of personal accountability.

Loan and Mortgage Fraud

Fake IDs are also used to apply for loans and mortgages under assumed identities. This not only places financial burdens on unsuspecting victims but also contributes to broader economic instability, especially when these fraudulent activities are conducted on a large scale.

The Impact of Financial Fraud

Individual Victims

The immediate victims of financial fraud facilitated by fake IDs are often individuals whose identities are stolen or mimicked. They can face credit score damage, financial loss, and the daunting task of proving their innocence, which can take years to resolve.

Financial Institutions

Banks and other financial institutions suffer reputational damage and financial losses due to fraud. They also incur increased operational costs associated with improving security measures and conducting investigations to prevent future incidents.

Economic Consequences

On a macro level, widespread financial fraud can undermine confidence in the banking system, affect credit markets, and contribute to economic instability. The ripple effects can impact interest rates, investment strategies, and even regulatory policies.

Strategies for Combating Financial Fraud with Fake IDs

Enhanced Verification Processes

Financial institutions are increasingly employing advanced verification processes, including biometric checks and digital ID verification systems, to combat the use of counterfeit documents. These technologies offer more reliable means of authenticating identities and reducing the incidence of fraud.

Cross-Sector Collaboration

Collaboration between financial institutions, regulatory bodies, and law enforcement agencies is crucial in addressing the issue of financial fraud. Sharing information about fraudulent activities and counterfeit documents can help in developing more effective detection and prevention strategies.

Public Awareness and Education

Educating consumers about the risks of identity theft and the importance of protecting personal information is essential. Awareness campaigns can inform the public about the signs of financial fraud and encourage vigilance in monitoring financial statements and credit reports.

Conclusion

The intersection of fake IDs and financial fraud presents a complex challenge that requires a multifaceted response. Through the adoption of advanced verification technologies, collaborative efforts across sectors, and comprehensive public education campaigns, it is possible to mitigate the risks associated with financial fraud. Addressing this issue is not only crucial for protecting individuals and institutions but also for maintaining the stability and integrity of the financial system.