Do you want to become a successful trader? Are you feeling overwhelmed by the prospect of reaching your trading goals? Don’t be discouraged; with the proper roadmap, setting realistic goals and achieving success in trading can be simple.

This article will provide valuable advice on mapping out an effective strategy for trading success, from defining achievable objectives to creating manageable timelines and developing productive work habits. We’ll also discuss tips for dealing with potential setbacks so that you can stay focused on obtaining your financial goals. With these strategies in hand, traders at any level can develop the skills necessary to move closer towards their desired outcomes.

Identify Your Trading Goals and Objectives

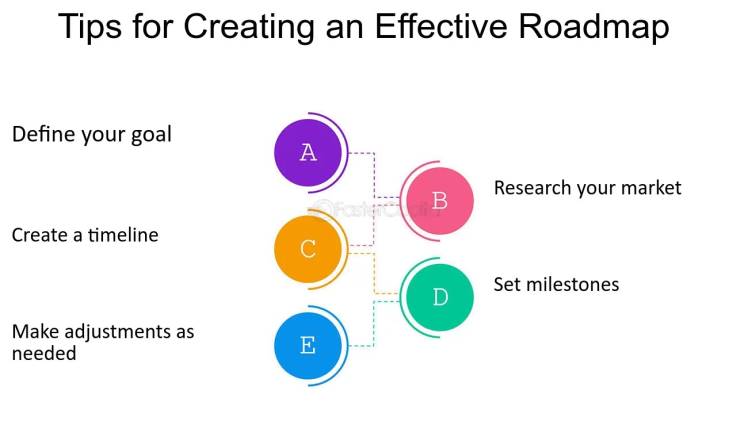

Before embarking on any journey, knowing where you’re headed is essential. The same principle applies to trading; with a clear set of goals and objectives, staying motivated and on track can be more accessible. So, the first step in building your roadmap for trading success is identifying what you hope to achieve from your trading activities.

When setting goals, make sure they are specific, measurable, achievable, relevant, and time-bound (SMART). Your objectives should be clear and well-defined so that you have a clear understanding of what you’re striving for. They should also be quantifiable to track your progress and determine when you have reached them. At the same time, setting realistic goals that align with your trading skills, resources, and time availability is essential. Otherwise, you may become discouraged and give up on your aspirations.

Furthermore, ensure your goals are relevant to your overall trading strategy and long-term financial objectives. For example, if you’re a day trader looking to generate daily income, setting a goal of achieving long-term investment gains may not align with your current approach. Lastly, it’s crucial to set a timeline for reaching your goals. It will help you stay focused and motivated, ensuring that you make steady progress towards your desired outcomes. An ADS broker can provide valuable guidance and resources for setting realistic trading goals.

Establish a Risk Management Plan

Trading involves risk, so it’s essential to develop a risk management plan as part of your trading roadmap. This plan should include strategies for managing potential losses and protecting capital from significant market downturns. Having a risk management plan in place can ensure that your trading activities are sustainable in the long run.

Some critical elements of an effective risk management plan include setting stop-loss orders, diversifying your portfolio, and regularly reevaluating your risk tolerance. These measures can help you mitigate potential losses while allowing room for growth and flexibility in your trading strategy.

Develop a Trading Plan

After clearly defining your goals and establishing a comprehensive risk management plan, the next crucial step in your trading journey is to develop a well-thought-out trading plan that perfectly aligns with your objectives. This meticulous plan should outline your approach to trading and delve into various factors that contribute to your trading success. These factors include but are not limited to, entry and exit strategies, trade sizes, profit targets, and even contingency plans.

A truly well-developed trading plan considers critical elements such as thorough market analysis, meticulous risk management measures, and careful consideration of your personal trading preferences. It should be a dynamic blueprint that allows flexibility to adapt to the ever-changing market conditions and provides room for continuous improvement. Remember, a solid foundation built upon a well-crafted trading plan is the key to consistent success in trading.

Research Your Investment Opportunities

To make well-informed trading decisions, conducting thorough research and gaining a deep understanding of the various investment opportunities available is crucial. It includes staying up-to-date with market trends, analysing company financials, and keeping a keen eye on global economic news and events that may impact the financial markets.

Furthermore, it is of utmost importance to exercise selectivity in your investments and focus on opportunities that align with your trading goals and risk management plan. By carefully evaluating and researching your investment options, you can make more informed and strategic decisions that increase your chances of success in the dynamic world of trading and investing. Remember, the more detailed and meticulous your research, the better equipped you will be to seize lucrative opportunities and mitigate potential risks.

Take Action

Setting goals, developing a trading plan, and conducting thorough research are all essential components of building a roadmap for trading success, but they need action. Sticking to your plan and actively putting in the work necessary to achieve your objectives is imperative.

Moreover, it’s crucial not to let setbacks discourage you from staying on track. While losses and challenges are inevitable in trading, viewing them as learning opportunities and continuing with determination and perseverance is essential. Remember, success in trading comes from continuously learning, adapting, and taking action towards your goals.