Bitcoin, the pioneering cryptocurrency, has revolutionized the arena of finance and funding. As it continues to adapt, its integration with current technological developments promises to shape the future of investing in approaches formerly unimagined. In navigating the evolving landscape of Bitcoin investment and technological trends, connecting with resources like immediate-growth.com/ can provide valuable insights and expert guidance, It helps traders access specialized knowledge, stay informed about the latest innovations and opportunities in cryptocurrency.

The Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is possibly one of the most massive technological traits affecting Bitcoin and the wider cryptocurrency atmosphere. DeFi structures utilize the blockchain era to recreate conventional monetary systems, consisting of lending, borrowing, and trading, in a decentralized manner. This shift is pushed by smart contracts—self-executing contracts with the phrases of the agreement at once written into code.

For Bitcoin investors, DeFi represents a new frontier. While Bitcoin itself isn’t directly part of most DeFi platforms (which predominantly use Ethereum), its function as a reserve asset and collateral is growing. Innovations in wrapped Bitcoin (WBTC) allow Bitcoin to be used inside the Ethereum environment, bridging the distance between Bitcoin and DeFi. This integration complements liquidity and opens up new funding possibilities, inclusive of yield farming and staking, in which traders can earn returns on their Bitcoin holdings.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) are reworking several industries, and cryptocurrency funding is no exception. AI algorithms and ML fashions are increasingly getting used to research considerable amounts of data, identify styles, and expect marketplace traits. This technological advancement permits traders to make more knowledgeable decisions and optimize their buying and selling strategies.

In the context of Bitcoin, AI and ML can be applied to expand advanced trading bots that execute trades based totally on actual-time data and predictive analytics. These bots can react to market fluctuations faster than human investors, potentially increasing the efficiency of investment strategies. Additionally, AI-powered gear can assist in threat evaluation through analyzing historical information and forecasting capacity market scenarios, which is critical for navigating the risky Bitcoin marketplace.

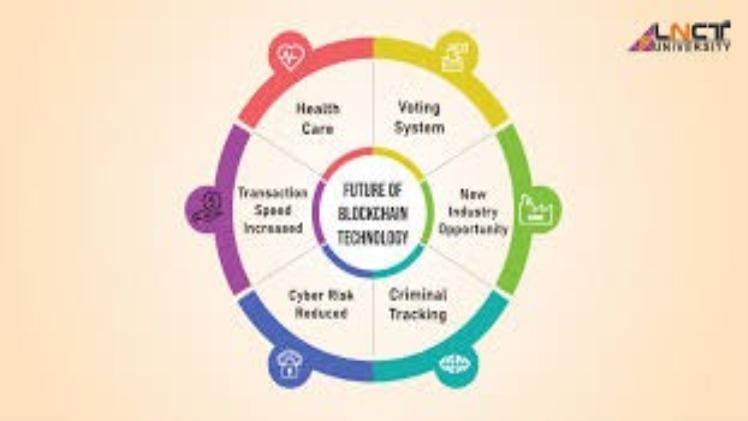

Blockchain Innovations and Scalability Solutions

The scalability of blockchain technology remains an important undertaking, specifically for Bitcoin, which is known for its slower transaction speeds and better fees in comparison to other cryptocurrencies. However, current technological improvements are addressing these issues and improving Bitcoin’s scalability.

One such innovation is the Lightning Network, a layer-2 answer designed to facilitate quicker and more inexpensive transactions with the aid of developing off-chain charge channels. The Lightning Network allows microtransactions and on-the-spot bills, which could substantially improve Bitcoin’s application as a way of conducting regular transactions.

Another development is the continuing research and implementation of sharding and sidechains. Sharding entails breaking the blockchain into smaller, more attainable portions, making an allowance for the parallel processing of transactions.

Quantum computing and cryptographic security

Quantum computing provides both opportunities and challenges for the cryptocurrency global. While nonetheless in its early stages, quantum computing has the ability to interrupt contemporary cryptographic algorithms that stable Bitcoin and different cryptocurrencies. This poses a tremendous risk to the safety and integrity of blockchain networks.

In response, researchers are developing quantum-resistant cryptographic algorithms designed to shield Bitcoin against the potential threats posed by quantum computing.

The Evolution of Bitcoin Investment Platforms

The technological evolution extends beyond Bitcoin itself to the platforms and gear used for investing in cryptocurrencies. Traditional exchanges are evolving to comprise more advanced features, which include integrated AI analytics, advanced user interfaces, and superior security measures.

New funding structures are also emerging, presenting revolutionary ways to spend money on Bitcoin. These consist of decentralized exchanges (DEXs), which give users extra control over their assets and take away the need for intermediaries.

Enhanced privacy features

Privacy remains a critical difficulty for many Bitcoin investors. Technological improvements in privacy capabilities are helping to deal with these concerns. Innovations consisting of exclusive transactions and zero-expertise proofs are improving the privacy and anonymity of Bitcoin transactions without compromising the transparency and protection of the blockchain.

Confidential transactions cover transaction quantities, while 0-information proofs allow the verification of transactions without revealing touchy information.

Conclusion

The future of Bitcoin investment is carefully intertwined with technological advancements. From the rise of DeFi and AI-pushed trading to improvements in scalability and privateness, these developments are shaping the landscape of Bitcoin investment and providing new opportunities for buyers. Investors who include those technological innovations and adapt their strategies accordingly will be well-positioned to capitalize on the possibilities that lie ahead. The ongoing advancements in blockchain generation and the broader cryptocurrency atmosphere promise to redefine the way we invest and have interaction with digital property, making it a thrilling time for those worried about Bitcoin and beyond.