If you are studying about things like gst in tally erp9 you probably have encountered the term accounting voucher. It can be a confusing term for many accounting students and business owners. Don’t worry we will clarify every aspect of the accounting voucher for you. Visit this page for more info. An accounting voucher is a document issued by the accounting department which confirms that all the transactions and accounts have been properly recorded. The accounting voucher is used to record all the transactions from cash receipts to cash payments. It also records expenses incurred on certain items such as salaries or other payments.

It is prepared by the head of the accounting department, who writes down the details of each transaction in a separate column on the voucher form. Each column has its own heading which includes information such as amount, description, transaction number etc.

Benefits of accounting vouchers

- Accounting vouchers are a great tool for helping you keep track of your expenses. You can use these vouchers to track your money and make sure you are saving enough money for your family. If you are in college, this is also a great way to ensure you get the most out of your tuition.

- If you want to save money on your rent or mortgage, then accounting vouchers can help with that as well. You can use them in order to save money so that you can pay down your debts faster and get into a better financial position sooner.

- These vouchers will also help you track how much debt you have and how much money is coming in each month. This will allow you to see which bills can be cut first and which ones need to be paid off before moving forward with other things like buying a new car or putting money towards retirement savings accounts.

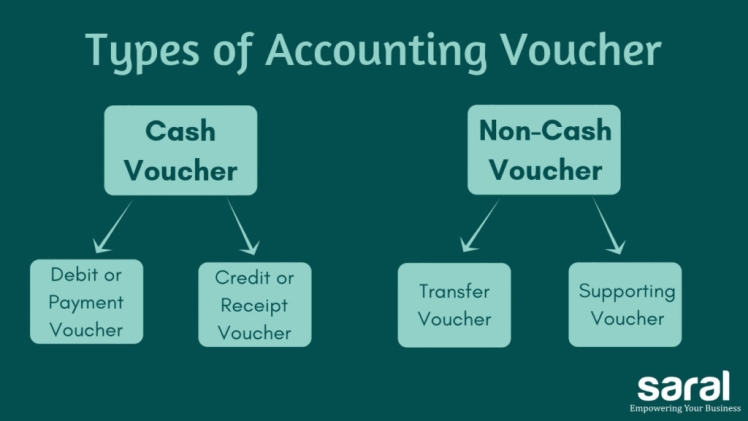

Types of accounting vouchers

There are many different types of vouchers in tally however, here will discuss the four main types of accounting vouchers:

- Debit or Payment voucher

A debit or payment voucher is a receipt from the customer indicating that money has been paid to the supplier. This can be issued by cash, cheque, credit card or bank transfer. The key benefit of this type of receipt is that it enables you to keep track of all your transactions, allowing you to assess and manage your cash flow. It also provides an audit trail for supporting documents such as invoices and purchase orders.

- Credit or Receipt voucher

A credit or receipt voucher confirms that an invoice has been paid in full and is eligible for collection with no outstanding balance. A credit voucher confirms that the amount on the invoice has been paid in full by a customer, supplier or other third party (e.g., a bank). A credit voucher should contain all relevant details so that the transaction can be properly processed by your internal systems and processes.

- Supporting voucher

The supporting voucher is used to provide appropriate and specific evidence of expenditure that is not included in the main vouchers. The supporting vouchers are often created as electronic documents, but can also be created on paper.

- Non-Cash or Transfer voucher (Journal voucher)

The non-cash or transfer voucher (journal voucher) records the opening balance and closing balance of cash receipts and payments, as well as any adjustments to those balances. It accompanies the other vouchers so that all transactions can be clearly traced from one point in time to another point in time.