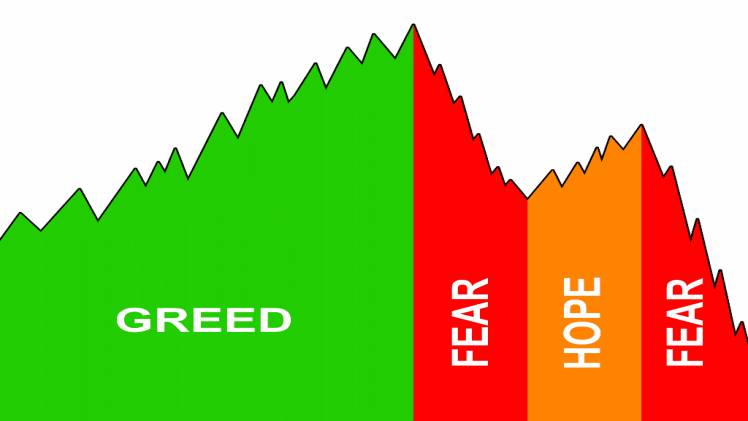

The major drivers of financial markets are frequently identified as fear and greed. This is clearly an oversimplification, but fear and greed do significantly influence the psychology of trading. Knowing whether to embrace or tame these emotions might prove to be the difference between a successful trade and a short-lived trading career.

Read on to find out more about fear and greed in forex trading, including when these emotions are most likely to surface and how to best handle them.

The Reality on Fear And Greed in Trading

Fear and greed are widespread among traders and may be damaging if not controlled. The reluctance to start a trade or the early closing of a winning trade are two common manifestations of fear. Conversely, greed manifests when traders add cash to winning trades or over-leverage with the aim of profiting from minor market moves.

There are various traces of the origins of these two drivers, but rational analysis reveals that both human and greed are derived from the innate survival instinct of fear.

What is fear?

We are aware that the instinct to fight or flee present in each of us has some connection to fear. That is the sensation we have when we perceive a threat. As positions go against them, traders feel fear since their trading account is at risk.

Seeing a position go against you invokes the fear of realising a loss, which causes traders to hang onto losing positions much longer than they should. As we examined over 30 million live trades to unearth the Traits of Successful Traders, this was discovered to be the most common error traders make.

Just before entering the market, there is a second scenario when fear tends to overcome traders. Despite the analysis suggesting a strong entry, traders may become bogged down by their fear of loss and abandon a well-thought-out trade.

When markets have plummeted, fear is frequently evident, and traders are reluctant to buy from the bottom. In this scenario, traders frequently choose not to open a trade out of fear that the market will continue to fall and they will lose the opportunity to profit from the upturn.

What is greed?

Greed is extremely different from fear, yet it may easily put traders through as much difficulty if it is not controlled. It tends to happen when a trader tries to take instant advantage of a winning trade by putting more money to the same trade in the hopes that the market will continue to move in the trader’s favour.

Greed may also surface when traders opt to “double down” after a failed trade hoping that adding more capital to the position would make it profitable. If the market continues against the trader, this is extremely perilous from the risk management perspective and may soon result in a margin call.

In the financial markets, greed has frequently shown. One such moment occurred during the dot-com bubble, when people acquired an increasing number of online stocks, greatly inflating their value before everything crashed. Bitcoin is a more contemporary example; investors flocked to the cryptocurrency, believing that its value would only rise before it came crashing down.

Managing Greed and Fear to be a Successful Trader

There are several strategies to manage your emotions and prevent fear and greed from affecting your trading choices or overall performance.

Have a Trading Plan

To prevent emotional impulses that vary from the strategy, traders should have a trading plan. Overleveraging, removing stops on losing bets, and doubling down on lost positions are a few instances of this.

Lower Trade Sizes

“Lowering your trade size is one of the simplest strategies to lessen the emotional impact of your trades.”

In this post on controlling trading emotions, this was only one of several insightful observations made.

The article goes on to say that since there is no real financial risk, making a big trade on a demo account won’t make you lose any sleep. Nonetheless, traders will undoubtedly feel stressed after seeing significant price changes on a live trade. It is essential to control such tension since it might result in poor choices that could harm the trading account.

Keep a Trading Journal

During trading, traders must also be responsible to themselves. Making a trading notebook is the best approach to do this. Trading diaries let traders keep track of their trades, identify successful trading tactics, and tweak unsuccessful ones. While analysing the outcomes of your trades and eliminating poor trade methods, it’s critical to do it without any emotion. It is a good idea to note when you execute trades i.e. what time of day or during which session.

Learn From Others

For others to take advantage of such qualities in the future, we set out to find out what had been successful for traders in the past. The traits of Successful Traders study is the end outcome of this.

This study demonstrates the importance of emotion in trading by demonstrating that traders lost money on average despite having more winning trades than losing trades. This was due to the fact that lost trades outnumbered winning trades, meaning that traders stood to lose more when the market moved against them than they would get if the market moved in their favour.

Final Words

More than 50% of the time, traders are correct, but they lose more money because they lose more money on failing trades than they do on winning trades. A risk/reward ratio of 1:1 or above must be achieved by traders using stop loss and limitations.