The Foreign Exchange (Forex) Market is the World’s Largest and Most Liquid Market, Trading 24 hours a day, 5 days a week in all major currencies of the globe. Finding a trustworthy online broker is a need if you want to trade forex. Success in trading foreign currencies requires using a reputable forex broker. You should check that the forex broker you’re considering is supervised by a reliable government agency in your area. That way, you know your money is safe and the broker is operating honestly and openly.

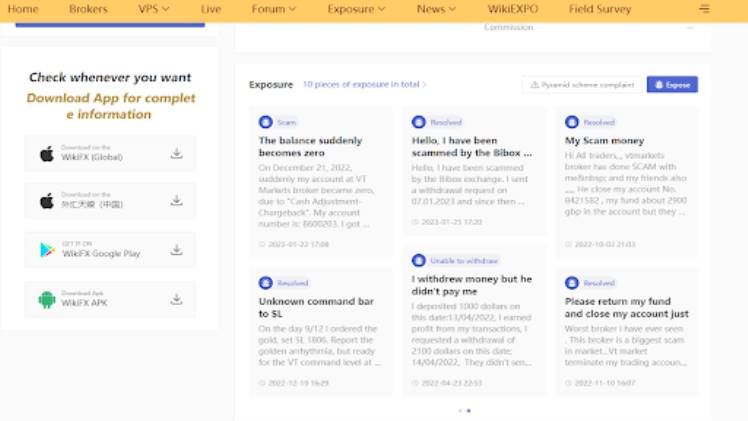

WikiFX is a trusted resource for assessing a forex broker’s regulatory status, and its expert team has spent countless hours researching the legal standing of numerous FX brokers so that they can provide investors with extensive information to aid in making informed decisions.

Here at WikiFX, you’ll learn about the most important factors to take into account when selecting a forex broker:

Regulation

One of the first things to double-check is licenses. Using an unlicensed broker who does not adhere to regulatory compliance could have disastrous consequences for your trading account. To safeguard investors and traders, governments have instituted regulatory agencies with authority over registered brokers. In addition, it might be costly to renew permits, so only honest businesses will bother.

Time of Being

Try to find businesses that have been in operation for quite some time. The longer they’ve been available, the more reviews you’ll have to look over when making your choice. Older businesses also place a higher premium on credibility. Due to this, there is a greater likelihood that they will provide satisfactory service and meet their commitments.

Trading Conditions

The services and terms offered by each brokerage platform are unique. Consider what you value most in a solution first. Does your plan involve using a margin account for highly leveraged trades, for instance? Want to make a small first investment? In what ways are platform deposits and withdrawals simplified? Just how much of a cut does the broker get? When trading foreign exchange, picking a broker with low spreads is crucial to your bottom line.

Trading Platform

Pick a broker with a trading platform that suits your needs in terms of ease of use, stability, and accessibility to resources. Pick a broker with a platform that fits your needs in terms of usability, dependability, and trading features.

Brokers may either provide their own trading platform or access to popular third-party systems such as MetaTrader 4 and 5. Your trading preferences, level of expertise, and trading style should all play a role in determining the platform you use.

Customer Support

The forex market never sleeps. To that end, the broker’s support services should be available whenever they’re needed. Selecting a broker that cares about your needs and is easy to get in touch with is crucial.

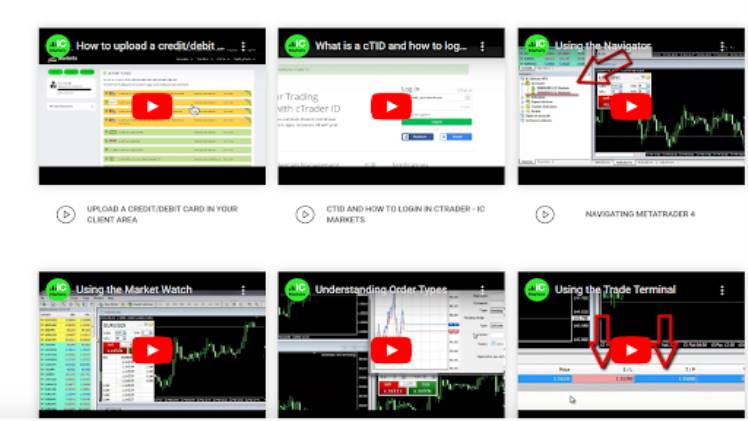

Educational Resources

To succeed in forex (Forex), education is crucial for novice traders. A competent forex broker will provide a number of learning tools for newcomers to the market. Webinars, video lessons, a trading academy, and other textual resources are all examples of what can fall into this category.

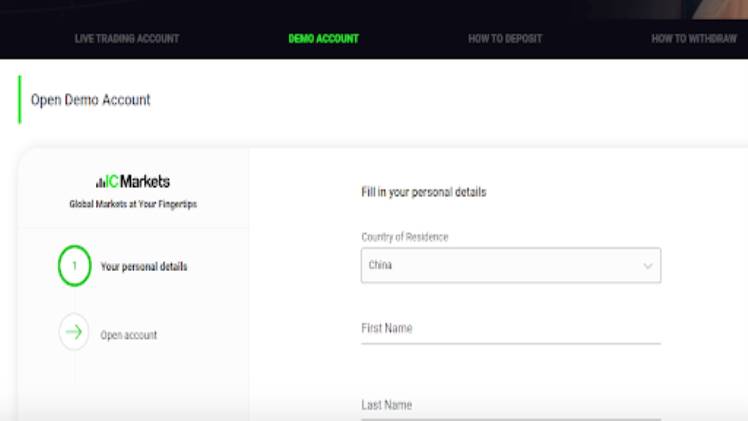

A demo account, which is provided by several forex brokers, allows novice traders to get some experience without actually investing any money. For those interested in practicing their trading skills with virtual funds, a demo account is a great option.

User Reviews

Reviews from other traders are often more reliable than the firm’s own marketing language when it comes to determining the quality of a forex broker. Therefore, testimonials are a good barometer of the quality of the services actually provided by the broker.