The move to digital currency trading will continue to accelerate in the coming years as new financial tools are developed. As automation becomes a practical outlet for the human workforce, cryptocurrencies have begun to transform into bona fide revenue-generating platforms. Overall, it appears that the digital asset market is continuing to mature as new entrants are attracted to the lucrative cryptocurrency industry. In this article, we explore how this transition will shape the future of cryptocurrency and how it’s likely going to impact the development of automated trading systems.

Analysis of New Entrants into the Crypto Market

As digital currencies continue to mature, it appears that traders are becoming more skilled and well-versed in how to utilize the tools provided by financial technology companies. Utilizing this newfound knowledge, a growing number of individuals are leaving their full-time job in order to utilize their trading savvy for personal gain. One of the most interesting trends in the crypto-trading industry is the emergence of individuals who are trading on their own as a full-time endeavor.

Now that cryptocurrencies have secured their financial value and established themselves as legitimate investment vehicles, traders are flocking to crypto-markets in hopes of striking it rich with a few quick trades. For example, many individuals are creating their own businesses centered around digital trading currencies. In addition to this, there has also been an increase in interest with regard to trading courses and other educational material that will help educate aspiring traders on how to be successful within the cryptocurrency market.

The notion that digital currencies are here to stay has firmly solidified itself within the mainstream consciousness.

Analysis of Automated Trading Strategies

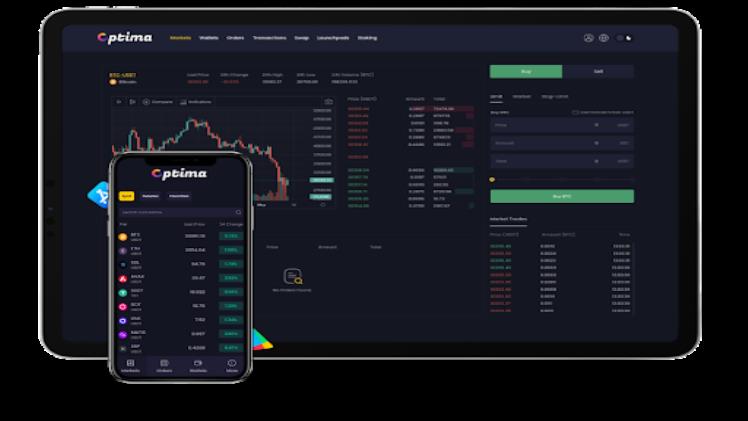

There are a number of traders who offer automated trading platforms. This represents an interesting shift in the type of automation systems that are being developed. Traders have previously used robots to automate their trades, but these systems were made up of basic algorithms that relied on artificial intelligence (AI) to provide a winning trade strategy. However, now they are starting to implement more complex trading strategies that utilize AI within their algorithm, which can better handle possible contingencies.

When examining how automated trading will evolve, it’s important to look at how this transition occurred for traditional markets such as stock markets. Implementing cryptocurrency exchange script solutions is one of the fastest-growing ways to monetize trading strategies. In the past, trading strategies were manually implemented by specific traders who were then trusted by clients. However, this practice is becoming obsolete as new tools are developed that will speed up the market development and increase profits for traders.

Cryptocurrency exchange scripts have already begun to replace traditional automated trading solutions as a result of their faster execution times, increased flexibility, and advanced capabilities. For business owners, cryptocurrency exchange software offers the opportunity to diversify their trading model and offer additional products to their clients. In addition, businesses will no longer be required to make a substantial financial commitment in order to rent out the services of an external trader.

The open-source cryptocurrency exchange software CCTech is ideal for beginners who are about to start their own business. It has a high level of scalability and is highly customizable, and it is also highly secure. The exchange software can be used by individuals, startups, ICO entrepreneurs, traders who run trading bots and arbitrage businesses, as well as crypto entrepreneurs who dream of starting their own exchange.

Analysis of Market Maturation

In order for automated trading solutions to develop at a steady rate, the cryptocurrency market must continue to mature. As the market expands over time, we will start to see trading firms offering more advanced systems that are designed for experienced traders.

Automated trading platform providers can utilize sophisticated and complex algorithms that are capable of generating winning trades within an extremely short period of time. These types of systems are able to identify and determine the best price action to apply to each purchase or sale order.

How this transition is going to play out in the cryptocurrency market will depend upon how established the industry becomes and how fast it matures.

Conclusion

Many investors are currently betting on cryptocurrencies as a way to make money in the short term. In the past, trading was something that was done solely by high-frequency traders who used automated trading software to execute high volumes of trades and trade under the radar. The fact that this industry is now becoming more mainstream has allowed for efficiencies in making artificial intelligence-based automated trading systems easy for beginners to use.